I

Although the economic slowdown has some wondering about the health of the industrial real estate sector, the need for shorter shipping times will spur companies to continue to look for space around the country.

Q1 2023

Accordingly, investors, lenders, and developers took notice and began to dump unprecedented amounts of capital into providing new and needed inventory. But now, with a softening economy and a bit of a pull-back in the pace of e-commerce’s growth, many are wondering if the industry moved too far and too fast. In other words, did the market overshoot the equilibrium?

Planning Years in Advance

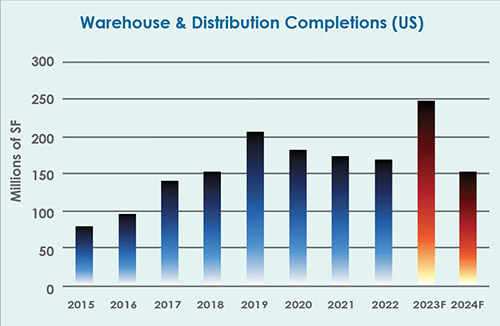

Figure 1 illustrates the substantial increase in warehouse and distribution completions through 2022, as well as our best estimate of what is to come within the next couple of years. It is important to be mindful that real estate development is unique, as expectations tend to play an outsized role in both supply and demand performance. Stakeholders must plan years in advance for projects to assure proper due diligence and gain necessary approvals; even then, construction can take years to complete. The factory cannot simply be run an extra shift that month to satisfy current demand.

With a softening economy and a bit of a pull-back in the pace of e-commerce’s growth, many are wondering if the industry moved too far and too fast. All of this implies that many of the new industrial projects built within the previous few years were in the works prior to the pandemic shock. This also implies that only now will we really begin to see how well the market has performed in terms of estimating demand. Supply will increase another 5 percent or about 400 million square in the next couple of years, with much of it speculative. We have already seen the likes of Amazon admit that some mistakes were made and expansion was too fast, a potential harbinger for the industry at large.

Figure 2 – A Concerning Spike in Watch-list Activity. Source: Moody’s Analytics

Is There Trouble Ahead?

Figure 2 presents another early warning sign. After an incredibly solid couple of years, the number of loans with CMBS exposure that are currently watch-listed is increasing, something not apparent for the other major property types. Watch listed doesn’t necessarily mean major trouble ahead; significant near-term lease expirations, not necessarily a concern, can be the cause, but it is an indicator to watch closely.

Given the theme of expectations, the current bullishness of potential tenants in regards to their expected future prospects is vital for filling all of this new space. As Amazon and others have shown, that sentiment can quickly change, hence the near-term concerns of overshooting in the market.

Save for a major supply-side shock, the economy and retail spending will grow slowly, but will grow. In typical real estate cycle fashion, if companies pull back a bit on their expansion plans, at the same time new speculative supply hits the market, rents, occupancies, and even capital market activity could severely drop. The question becomes, will the economy get bad enough for companies to pull back?

At this point, it is unlikely — at least not bad enough to severely dent leasing activity. Industrial space performance, particularly warehouse and distribution, has historically been highly related to consumption, and maybe now more than ever.

Figure 3 shows that relationship and our current projection for retail spending and warehouse and distribution rent growth at the national level. Note that we do anticipate a slowdown of this activity, but not a crash; in fact, nowhere near a crash. Inflation is slowly but surely being tamed and interest rates have just about peaked. Save for a major supply-side shock, the economy and retail spending will grow slowly, but will grow.

Figure 3 – Retail Spending will remain Resilient. Source: Moody’s Analytics CRE

Even with a short-term slowdown of the economy, the strong tailwinds will keep pushing companies to look for expansion options. E-Commerce Will Continue to Make Gains

Finally, one important difference between this cycle and past cycles is the mostly agreed upon long-term need for additional industrial expansion within the U.S. E-commerce will continue to make gains in its share of retail sales, likely moving from its current 15 percent to at least 20 percent within this decade. Parts of the Inflation Reduction Act and the CHIPS act are clear illustrations for the desire to re-shore manufacturing; and more and more, it seems likely that at least some of the last 50 years of globalization’s growth will be unraveled over the next decade. Additionally, the race to shorter and shorter shipping times will continue to shake up the need for, and location of, industrial space around the country.

In sum, even with a short-term slowdown of the economy, the strong tailwinds will keep pushing companies to look for expansion options, and industrial real estate will remain a preferred asset for years to come. Look for rent growth to decelerate toward long-term averages this year and next, and occupancy rates to remain a shade below recent record highs. The market has yet to overshoot the equilibrium.

-

Thomas LaSalvia, Director of Economic Research, Moody’s Analytics

Thomas P LaSalvia, Ph.D. is director of Economic Research at Moody’s Analytics specializing in commercial real estate across property types. While his expertise encompasses space and capital market performance, Thomas’s keen interest lies within the subdiscipline of optimal location theory. Dr. LaSalvia regularly presents his research to a variety of clients and organizations with his insights frequently featured in leading industry and national publications, including The Wall Street Journal, The New York Times, Newsweek, Scotsman Guide, and Commercial Observer. Prior to joining Moody’s Analytics, Dr. LaSalvia was an industry consultant and served as a lecturer of Economics at The College of William & Mary.