The BRICS alliance is convincing developing countries around the world to stop relying on the US dollar for trade. A handful of countries believe that BRICS has the power to usher the world into a new financial era.

The BRICS alliance is striving to undermine the global dominance of the U.S. dollar by promoting the use of local currencies for trade settlements. Their goal is to bolster their native economies by reducing dependence on the U.S. dollar for cross-border transactions. The bloc is actively engaging with developing countries, advocating for the adoption of local currencies in trade instead of the U.S. dollar.

This development could significantly impact several financial sectors in the U.S., potentially leading to a market decline in the coming years. Should BRICS abandon the dollar for trade, the repatriation of USD currency could trigger hyperinflation in America. Three U.S. sectors are particularly vulnerable to the economic consequences if BRICS ceases using the dollar for trade.

Putting African Aspirations First

In this respect, we are ready to work with African countries on the development of their financial infrastructure. On connecting banking institutions to the financial messaging system that has been created in Russia. It permits making trans-border payments independently of Western systems that currently exist and impose restrictions,”

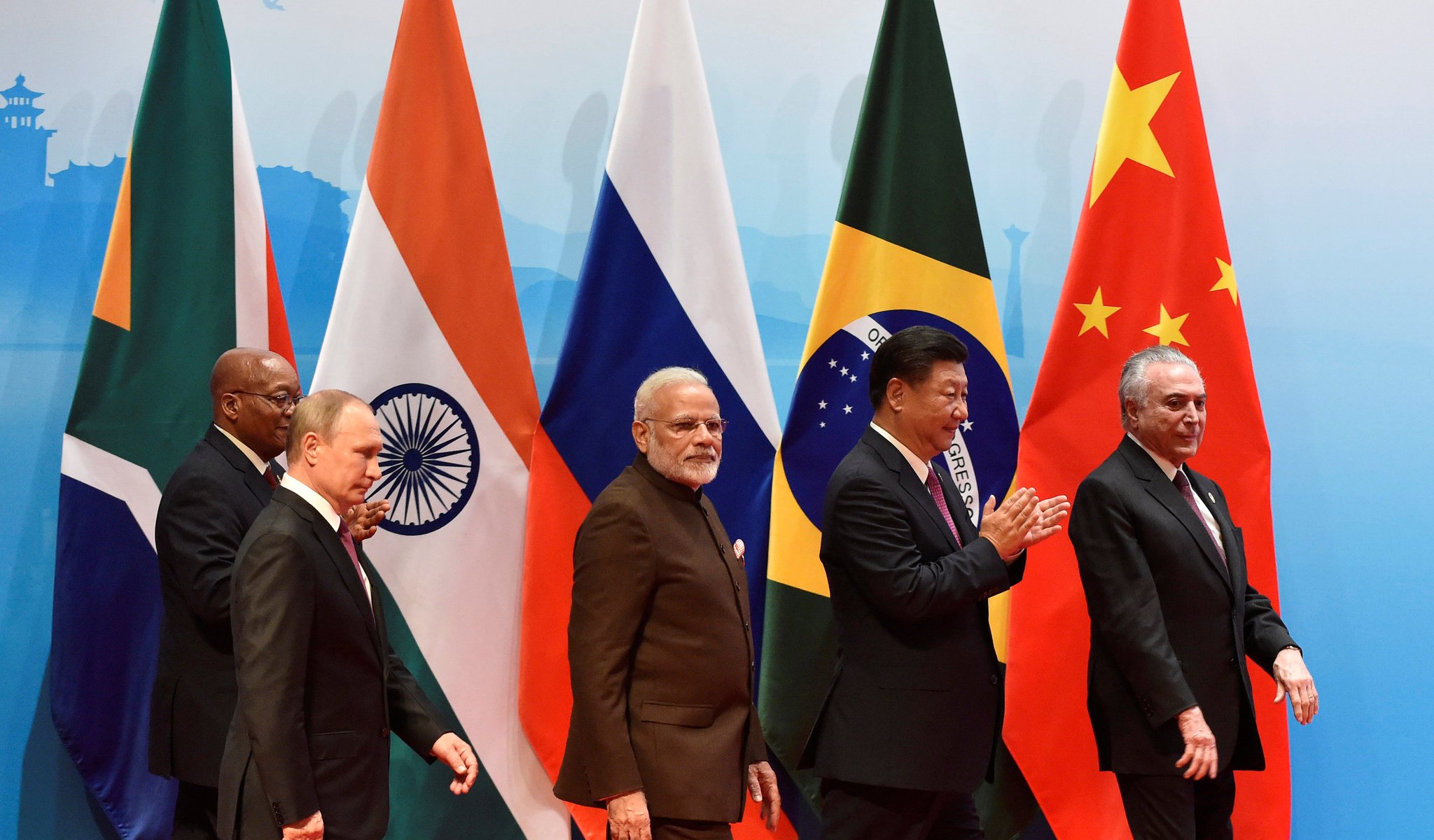

The latest report indicates that 36 countries have applied to join the BRICS alliance this year in 2024. All 36 countries have formally submitted their expression of interest to join the bloc, confirmed South Africa’s Foreign Minister Naledi Pandor. All the three dozen nations that have applied to be a part of the grouping are developing economies.

Banking and Finance

Technology and Fintech

Consumer Goods and Retail

First and foremost, the banking and financial sector will be the hardest hit as foreign exchanges will begin to decline. The forex markets run on supply and demand, and if the demand for the USD dips, the U.S. Central Bank will find it harder to import the dollar.

Firstly, if the central banks of BRICS countries cease accumulating the dollar, the U.S. will experience a repatriation of its currency. The U.S. has long exported its inflation to other nations, and the return of the currency would result in hyperinflation domestically.

Secondly, the technology sector will suffer as inflation in the U.S. leads to job losses. Furthermore, multinational corporations will incur higher costs to maintain operations and remain competitive without going under. BRICS has the potential to destabilize the U.S. economy if they cease accepting the dollar for payments.

hyperinflation domestically.

Lastly, and in conclusion, the prices of everyday consumer goods in the retail sector will soar. Inflation will grip the markets, causing the cost of daily commodities to rise significantly. Furthermore, the Biden administration must act swiftly to counter the BRICS alliance and prevent the decline of the U.S. dollar.

Three financial sectors in the U.S. will be directly affected if BRICS abandons the dollar for cross-border payments: banking, foreign exchange, and tourism, along with consumer goods and production. Here are the three financial sectors that will face significant impacts if the U.S. dollar is no longer used for settlements.

The recent developments indicate that developing countries look at the BRICS alliance as a promising bloc that can change their economies for good. BRICS is looking at ways to end dependency on the US dollar and promote local currencies for cross-border transactions. However, Pandor did not mention the names of the 36 countries that have expressed their interest in joining the BRICS alliance.