Nevertheless, the expanding influence of Beijing in the region has elicited apprehension in Washington and other global centers.

Summary

“Following the devaluation of cryptocurrencies, a free trade deal with China could benefit El Salvador economically. ”

Former Cannabis Users Given Chance To Join Law Enforcement, DOJ Extends Time Frame For Marijuana Pardons And More Pot Regs

Why Alibaba Stock Is Trading Lower Thursday? – Alibaba Group Holding (NYSE:BABA)

Introduction

China’s imprint in Latin America has undergone a swift and remarkable expansion since the beginning of the 21st century, heralding enticing economic prospects while simultaneously eliciting apprehension over the extent of Beijing’s influence. State-owned enterprises from China have emerged as key investors in the region’s energy, infrastructure, and space sectors, surpassing the United States to become South America’s primary trading partner. In tandem with these economic strides, China has diligently bolstered its diplomatic, cultural, and military footprint throughout the region, recently leveraging its support during the COVID-19 pandemic to provide crucial medical supplies, substantial loans, and substantial volumes of vaccine doses to Latin American nations.

However, concerns abound among the United States and its allies regarding the underlying intentions of Beijing in cultivating these alliances. Apprehensions center around China’s potential exploitation of these relationships to advance its geopolitical ambitions, such as the marginalization of Taiwan and the fortification of authoritarian regimes like those witnessed in Cuba and Venezuela. Acknowledging China as a “strategic competitor” in the region, President Joe Biden has expressed his commitment to fostering deeper economic cooperation with Latin America. Nevertheless, there are voices among analysts advocating for a more proactive stance from the United States, suggesting that further actions are warranted in response to China’s expanding presence in the region.

What is China’s history with Latin America?

China’s ties to the region date to the sixteenth century, when the Manila Galleon trade route facilitated the exchange of porcelain, silk, and spices between China and Mexico. By the 1840s, hundreds of thousands of Chinese immigrants were being sent to work as “coolies,” or indentured servants, in Cuba and Peru, often on sugar plantations or in silver mines. Over the next century, China’s ties to the region were largely migration-related [PDF] as Beijing remained preoccupied with its own domestic upheaval.

Following U.S. President Richard Nixon’s momentous visit to China in 1972, a significant shift occurred in Latin America’s diplomatic landscape as a number of countries recognized the communist government led by Mao Zedong. However, it was not until China’s accession to the World Trade Organization in 2001 that the foundations were laid for the establishment of robust cultural, economic, and political bonds between China and Latin American nations. Presently, countries such as Brazil, Cuba, Paraguay, Peru, and Venezuela stand as prime examples of Latin American states harboring sizable Chinese diaspora communities, underscoring the depth of their interconnectedness.

How have economic relations developed?

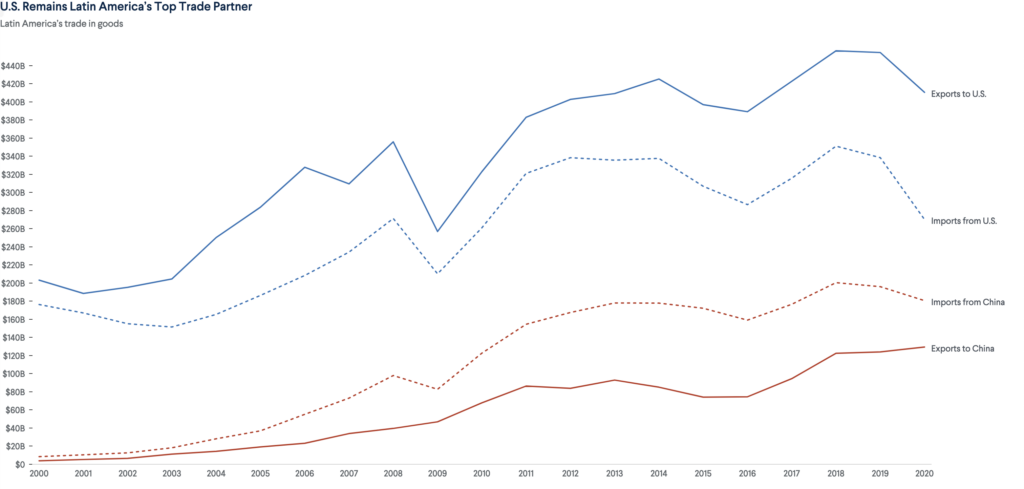

In 2000, the Chinese market accounted for less than 2 percent of Latin America’s exports, but China’s rapid growth and resulting demand drove the region’s subsequent commodities boom. Over the next eight years, trade grew at an average annual rate of 31 percent [PDF], reaching a value of $180 billion in 2010. By 2021, trade totaled a record $450 billion, a figure that remained largely unchanged in 2022, and some economists predict that it could exceed $700 billion by 2035. China now ranks as South America’s top trading partner and the second-largest for Latin America as a whole, after the United States.

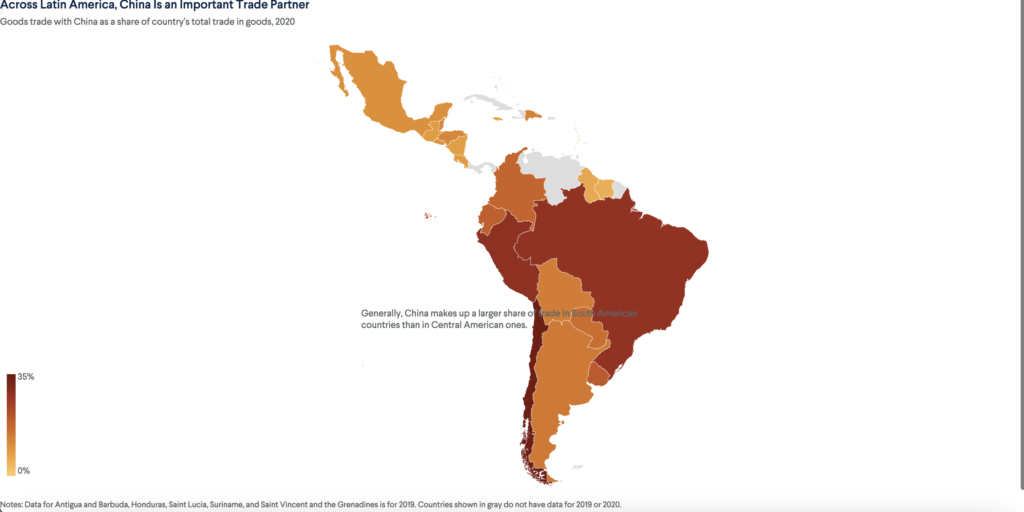

China’s insatiable appetite for Latin American resources has fueled a trade dynamic centered around the export of key commodities such as soybeans, copper, petroleum, and other raw materials crucial for China’s industrial progress. In turn, Latin America finds itself reliant on imports of higher-value-added manufactured goods from China, a phenomenon that some experts argue has posed challenges to the competitiveness of local industries, as Chinese products flood domestic markets with their cost advantage. As of 2023, Beijing has successfully concluded free trade agreements with Chile, Costa Rica, Ecuador, and Peru, amplifying its economic influence in the region. Moreover, a noteworthy twenty-one Latin American nations have already signed on to participate in China’s ambitious Belt and Road Initiative (BRI), a testament to the allure of increased connectivity and infrastructure development. (Negotiations for a free trade agreement with Uruguay remain ongoing, further reflecting the ever-evolving dynamics between the two regions.)

Chinese overseas foreign direct investment (OFDI) and loans also play a major role in strengthening ties with the region. In 2022, China’s OFDI in Latin America and the Caribbean amounted to roughly $12 billion [PDF], or about 9 percent of the region’s total OFDI. Meanwhile, the state-owned China Development Bank and the Export-Import Bank of China are among the region’s leading lenders; between 2005 and 2020, they together loaned some $137 billion to Latin American governments, often in exchange for oil and used to fund energy and infrastructure projects. In 2022 alone, loans totaled $813 million [PDF]. Venezuela is by far the biggest borrower; it currently has $60 billion worth of Chinese state loans, mostly relating to energy and infrastructure. That is nearly double the amount for the second-largest borrower, Brazil. Additionally, China is a voting member of the Inter-American Development Bank and the Caribbean Development Bank.

However, these ties have raised some concerns, particularly among regional governments. While Chinese loans often have fewer conditions attached, dependence on them can push economically unstable countries such as Venezuela into what critics call “debt traps” that can result in default. Indeed, several Latin American countries are seeking to renegotiate the terms of their debt. Critics also say that Chinese companies bring lower environmental and labor standards, and they warn that China’s growing control over critical infrastructure such as ports and energy grids poses national security risks. There are also fears of growing economic dependency in countries such as Chile, which sent more than $36 billion worth of exports, or about 38 percent of its total, to China in 2021.

What are China’s political interests in the region?

At the forefront is China’s desire to expand its sphere of influence through what it calls “South-South cooperation” [PDF], a development framework focused on aid, investment, and trade. China’s focus on soft power—including strengthening cultural and educational ties—has helped Beijing build political goodwill with local governments and present itself as a viable alternative partner to the United States and Europe.

Since former Chinese President Jiang Zemin’s landmark thirteen-day tour of Latin America in 2001, there have been dozens of high-level political exchanges. President Xi Jinping has visited the region at least eleven times since he took office in 2013. In addition to several bilateral agreements with countries in the region, China has signed comprehensive strategic partnerships—the highest classification it awards to its diplomatic allies—with Argentina, Brazil, Chile, Ecuador, Mexico, Peru, and Venezuela.

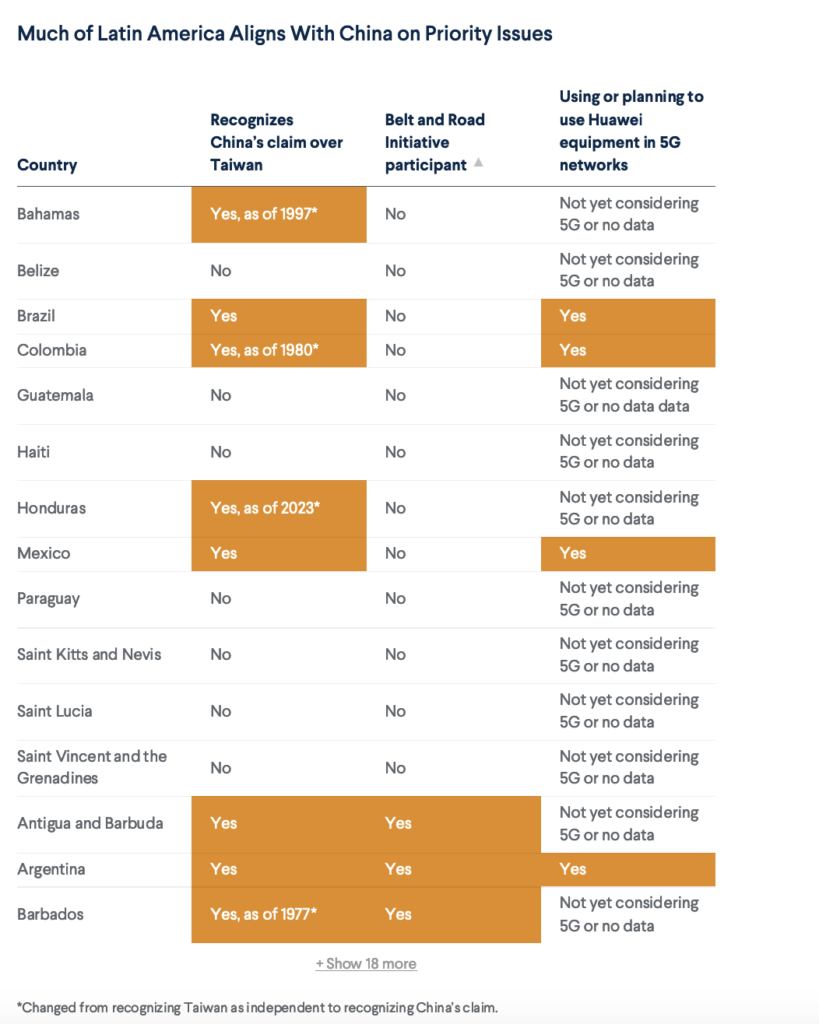

China’s relentless efforts to isolate Taiwan represent a pivotal factor shaping the geopolitical landscape in Latin America. Beijing’s stringent stance on diplomatic relations, refusing recognition to countries that affirm Taiwan’s sovereignty, has resulted in a notable decline in regional support for the island nation. Presently, only seven Latin American countries maintain formal diplomatic ties with Taiwan, indicating a substantial erosion of backing over the years. In a recent development, Honduras joined the ranks of nations switching their allegiance to Beijing, driven by Taipei’s denial of a substantial aid request. The Dominican Republic and Nicaragua have similarly transitioned their diplomatic alliances. As the remaining holdouts, including Haiti, confront mounting pressures, experts underscore the increasing challenges they face in maintaining their steadfast positions.

Simultaneously, as China deepens its engagement with Latin America, concerns arise regarding the reinforcement of authoritarian regimes within the region, notably Cuba, Nicaragua, and Venezuela. Observers assert that China’s involvement in these nations acts as a catalyst for the propagation of populism, as highlighted by Evan Ellis, a research professor specializing in Latin American Studies at the Strategic Studies Institute of the U.S. Army War College. It is crucial to emphasize that China’s intentions do not necessarily aim to foster antidemocratic systems; however, regimes with antidemocratic tendencies find a receptive collaborator in China, fostering a mutually beneficial partnership.

What security ties do they have?

Chinese government strategy on Latin America, as defined in its 2016 Defense Strategy White Paper and others, has underscored the importance of security and defense cooperation. China’s efforts to forge stronger military ties with its Latin American counterparts include arms sales, military exchanges, and training programs.

Venezuela remains the region’s top purchaser of Chinese military hardware after the U.S. government prohibited all commercial arms sales to the country beginning in 2006. Between 2006 and 2022, Beijing reportedly exported some $629 million worth of arms to Venezuela. Argentina, Bolivia, Ecuador, and Peru have also purchased millions of dollars worth of Chinese military aircraft, ground vehicles, air defense radars, and assault rifles [PDF]. Likewise, Cuba has sought to strengthen military ties with China, hosting the Chinese People’s Liberation Army for several port visits. U.S. intelligence officials have also raised alarm bells over evidence that China is strengthening its intelligence cooperation with Cuba.

China also participated in the UN peacekeeping mission in Haiti that began in 2004, including by deploying more than one hundred riot police to the country. After less than a decade, China withdrew from Haiti, but it still leads military training exercises across the region and provides supplies to local law enforcement. For example, China has provided Bolivian police departments with anti-riot gear and military vehicles during the Evo Morales Ayma administration, donated transportation equipment and motorcycles to police forces in Guyana and Trinidad and Tobago, and provided Ecuador with tens of thousands of automatic weapons [link in Spanish].

How did China help the region respond to the COVID-19 pandemic?

Many analysts say China’s “COVID-19 diplomacy” in Latin America was an effort to improve its image and curry favor with regional governments. This has included distributing medical equipment such as ventilators, diagnostic test kits, and masks; offering billions of dollars in loans for countries to purchase Chinese vaccines; and investing in local vaccine production facilities.

As of June 2022, China had delivered more than four hundred million vaccine doses to Latin America. Additionally, at least a dozen countries in the region signed vaccine contracts with Beijing, some of which included technology transfers and research cooperation with Chinese vaccine developer Sinovac. Chile was among the top recipients, with almost 70 percent of its COVID-19 vaccination coverage coming from Chinese vaccines; Argentina, Brazil, Mexico, and Peru also purchased tens of millions of doses.

Some countries, however, raised concern over Beijing’s vaccine diplomacy. Honduras and Paraguay, for instance, alleged that they faced pressure to renounce their recognition of Taiwan in exchange for doses. Some analysts suspected that China was also using its vaccine leverage to push for the expansion of Huawei, the controversial Chinese telecommunications giant. In Brazil, regulators reversed an earlier decision to bar Huawei from developing the country’s 5G networks weeks after China provided Brasília with millions of vaccine doses.

What are other major areas of bilateral cooperation?

Energy. Between 2000 and 2018, China invested $73 billion in Latin America’s raw materials sector, including by building refineries and processing plants in countries with significant amounts of coal, copper, natural gas, oil, and uranium. More recently, Beijing has focused on investing in lithium production in the so-called Lithium Triangle countries of Argentina, Bolivia, and Chile; together, the triad contains roughly half of the world’s known lithium, a metal necessary for the production of batteries.

What are other major areas of bilateral cooperation?

Energy. Between 2000 and 2018, China invested $73 billion in Latin America’s raw materials sector, including by building refineries and processing plants in countries with significant amounts of coal, copper, natural gas, oil, and uranium. More recently, Beijing has focused on investing in lithium production in the so-called Lithium Triangle countries of Argentina, Bolivia, and Chile; together, the triad contains roughly half of the world’s known lithium, a metal necessary for the production of batteries.

Chinese state-owned firms are heavily involved in energy development; PowerChina, for example, has more than fifty ongoing projects across fifteen Latin American countries as of late 2022. But the scale and scope of these efforts are stoking environmental and health worries. China has also taken an interest in the region’s renewable energy sector. The China Development Bank has funded major solar and wind projects, such as Latin America’s largest solar plant in Jujuy, Argentina, and the Punta Sierra wind farm in Coquimbo, Chile.

Infrastructure. Argentina, Brazil, Chile, Ecuador, Peru, and Uruguay are members of the Asian Infrastructure Investment Bank, where they have some voting power. Beijing has also financed construction projects [PDF] across the region, focusing on ports, airports, highways, and railways. However, a 2023 report [PDF in Spanish] by the UN Committee on Economic, Social and Cultural Rights analyzed the impacts of more than a dozen large-scale, Chinese-led infrastructure projects across the region and found that they have had negative effects on the environment and local Indigenous communities.

Meanwhile, China remains concentrated on building and developing “new infrastructure,” such as artificial intelligence (AI), cloud computing, smart cities, and 5G technology from telecom firms such as Huawei. Despite U.S. warnings against using Huawei equipment, which policymakers say leaves countries vulnerable to cyber threats from China, countries in the region are increasingly employing it: Huawei launched a two-year “5G city” pilot project in Curitiba, Brazil, in 2022.

Space. Beijing has also sought to strengthen space cooperation with Latin America, beginning with joint China-Brazil satellite research and production in 1988. China’s largest non-domestic space facility is located in Argentina’s Patagonian Desert, and it has satellite ground stations in Bolivia, Brazil, Chile, and Venezuela. Their proximity to the United States has heightened fears that they could be used to spy on U.S. assets.

How has the United States responded?

U.S. policymakers and military officials have raised concerns about China’s growing presence in Latin America even as Washington remains focused elsewhere, especially on the fallout of Russia’s war in Ukraine. “We are losing our positional advantage in this Hemisphere and immediate action is needed to reverse this trend,” argued Admiral Craig S. Faller [PDF], the former head of U.S. Southern Command, in 2021. President Donald Trump took a more hard-line approach than his predecessors by imposing sanctions on several countries and reducing funding to regional organizations; some analysts say this drove certain governments closer to Beijing. Trump also stepped back from trade relations with the region, withdrawing from the Trans-Pacific Partnership and renegotiating the North American Free Trade Agreement.

President Biden, who took the lead on Latin America policy during his tenure as vice president to Barack Obama, has long argued that the United States should renew its leadership role in the region to counter a rising China. Calling China a “strategic competitor” [PDF] and pledging to strengthen U.S. partnerships in the Western Hemisphere, Biden launched Build Back Better World (B3W) with his Group of Seven (G7) counterparts. The initiative aimed to counter China’s BRI by developing infrastructure in low- and middle-income countries, including in Latin America. However, the Biden administration committed only $6 million to B3W in its first year, and it was later renamed the Partnership for Global Infrastructure and Investment. At the 2022 Summit of the Americas, Biden promised a range of new economic initiatives.

Additionally, the Biden administration has sought to shore up support for Taiwan; rapidly increased its vaccine donations to the region, which totaled some sixty-five million doses by early 2022; and continued to raise concerns about Huawei. Still, some experts say Biden is not focusing enough on the region, particularly on trade. The latest report [PDF] by the U.S.-China Economic and Security Review Commission, an independent agency of the U.S. government, underscored the challenges that Beijing’s growing influence in Latin America poses to Washington.

Meanwhile, bipartisan legislation introduced by Senators Bob Menendez (D-NJ) and Marco Rubio (R-FL) seeks to counter China’s “malign influence” in the region by strengthening multilateral security cooperation and counternarcotics efforts. Other legislative proposals include calls for the United States to create permanent trade partnerships with countries in the Western Hemisphere to encourage the “reshoring” of supply chains from China to countries closer to home.

Recommended Resources

This Congressional Research Service report details China’s engagement with Latin America [PDF].

This International Monetary Fund working paper explains how China has been a major source of foreign direct investment in Latin America since the mid-2010s.

For Americas Quarterly, former Chilean Finance Minister Felipe Larraín and the Atlantic Council’s Pepe Zhang look at how China is sustaining its presence in the region.

This database from the Inter-American Dialogue and the Boston University Global Development Policy Center tracks Chinese loans to Latin America.

For the Carter Center, Margaret Myers and Rebecca Ray examine China’s impact [PDF] on regional development and stability.

For Foreign Affairs, the National Endowment for Democracy’s Julio Armando Guzmán discusses how the West can counter China in Latin America by investing in the region’s people.