D

Incentives for ESG efforts total more than $1 trillion worldwide. More specifically, when it comes to expenditures for sustainable and energy efficiency technologies and systems, determining the evolution and lifecycle costs, along with economic incentives, directly supports the business case and investment timing. To meet and exceed core goals around people and diversity, equity, and inclusion (“DEI”), deploying labor analytics with statistical forecasting provides the talent intelligence required to develop a workforce that aligns with the company’s vision.

As CFOs navigate their unique ESG missions, the physical footprint of a business can play a vital role in its ability to meet core objectives. ESG is not the future; it is already happening.

Businesses have been exploring and implement ESG principles touching every aspect — from people to logistics to facilities — whether that be offices, industrial, warehouses, and beyond. The drivers for this movement are not necessarily coming from government-led regulation, but instead from investors, consumers, and employees.

Studies show consumers are increasingly aware of ESG policies. More than eight out of 10 consumers today believe that companies should be actively developing these policies; and where they shop, eat, and spend money may be influenced by ESG initiatives. Meanwhile, amidst a heightened war for talent, employees indicate they prefer to work for companies that care about these issues.

Thus, with consumers and employees alike becoming increasingly aware of ESG policies and choosing how they buy and where they work accordingly, the reality of ESG is today. In fact, according to World Economic Forum data, more than 90 percent of companies in the S&P 500 index published a sustainability report. Remarkably, that figure is up from only 20 percent in 2011.

Opportunities for Grants and Incentives to Support the ESG Mission

Alignment of Location Strategy + ESG Objectives

As CFOs navigate their unique ESG missions, the physical footprint of a business can play a vital role in its ability to meet core objectives. By utilizing location strategy principles and innovative intelligence tools, a business can determine if its current footprint even allows it to meet these core objectives. If not, then these same tools can be used to identify alternative markets and sites that may prove advantageous for the future.

In addition to the footprint, the facility itself plays a major role in meeting ESG goals. As an example, the overall size of the facility can be impacted by ESG initiatives, such as more parking spaces and infrastructure improvements if there are plans for electric vehicles (EVs). Further, facility planning needs to consider the proximity of resources and infrastructure, such as routing impacts from EV maximum distances, location of alternative fuel sources, recycling facilities, and availability of key resources for long term future. Whether the facility is owned or leased also comes into play as landlords can be a critical partner.

Additional considerations for how CFOs and business leaders can utilize location strategy as part of their ESG mission include:

• Workforce — Recognizing the war for talent businesses are waging around the world, finding talent seems to be an insurmountable challenge for many companies. Add in the targeting of specific cohorts across a wide range of skill sets and occupations, businesses must utilize innovative tools and talent intelligence to develop effective strategies to meet core DEI and social goals.

• Workplace — While finding talent is a challenge today, and will continue to be into the future, retaining workforce is becoming increasingly difficult. Among a number of factors, the workplace itself is becoming more vital to attracting and retaining talent. As the focus turns often to amenities, key aspects and metrics around sustainability and environmental impact are progressively more critical to employees.

• Social Responsibility — How a company navigates the social responsibility of the business today is paramount for consumers and employees, as well as key stakeholders and investors. Where and how a business makes its products and delivers its services needs to be taken into account and assessed core to the company’s wider location strategy across its global footprint.

Deploying sustainable practices and technologies across a company is vital to successfully meeting ESG goals. • Sustainability — Deploying sustainable practices and technologies across a company is vital to successfully meeting ESG goals. Where and when these investments — whether large or small — are implemented must be at the center of the business case and the location strategy. Leveraging creative financial tools and economic incentives, often in partnership with governments, communities, and utility partners, is vital to achieving a bold corporate ESG mission.

• Governance — Location can have an incredible impact on a company’s governance practices. For example, a company will struggle with preserving transparent and ethical business practices if locating in a country with unchecked corruption and feeble labor laws.

Leveraging Economic Incentives — Financial Assistance to Offset Costs

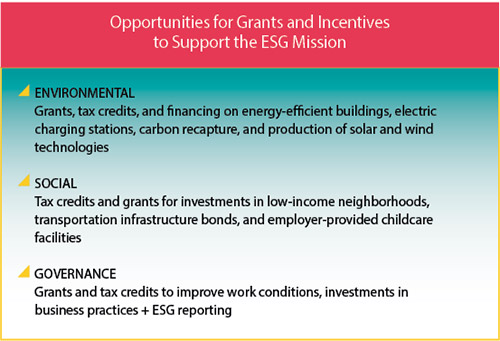

As businesses make significant investments in ESG across their portfolios, creative financial mechanisms and economic incentives need to be evaluated. Many governments around the world, particularly in North America and Europe, have allocated over $1 trillion in grant funds and tax incentives to support ESG-related capital and operational expenditures. The accompanying chart illustrates a high-level example of the opportunities for grants and incentives to support the ESG mission.

Across the dynamic North American landscape, federal, provincial, state, and local governments, along with utility companies, have established programs to lead and aid in the ESG mission. Since 2021, over $500 billion was authorized by the U.S. Congress that will support ESG activities and investments. Primarily in the form of tax credits and cash grants, the federal programs are coming out of legislation that includes the Inflation Reduction Act, CHIPS and Science Act of 2022, and the Infrastructure Investment and Jobs Act.

In Canada, federal programs like the Strategic Innovation Fund allocate funding to help businesses with industrial transition and to reduce greenhouse gas emissions. This $8 billion breaks out into three categories for company support: (1) decarbonization of large emitters; (2) transformation of key industrial sectors; and (3) development of clean technologies.

At the state and provincial level, programs have been established to provide direct incentives for businesses to invest in ESG initiatives. In California, companies can secure robust sales and use tax exemptions for projects investing in alternative energy and advanced transportation through the California Alternative Energy and Advanced Transportation Financing Authority. In Quebec, the provincial Eco-Performance Program provides grants for businesses investing in technologies to reduce greenhouse gas emissions and energy consumption.

In the United States and around the world, utility companies are also developing programs to incentivize companies to deploy sustainable practices, renewable energy systems, and energy efficiency technologies. An example comes from Arizona’s Salt River Project, a community-based, not-for-profit organization. Companies investing in EV charging stations can capture up to $15,000 in rebates for fleet electrification with the purchase and installation of eligible technologies.

As businesses make significant investments in ESG across their portfolios, creative financial mechanisms and economic incentives need to be evaluated. To reach vigorous sustainability goals, while also addressing significant energy challenges, the European Commission has launched a €1 trillion plus initiative to support businesses and governments and offset environmental and energy efficiency investments. Known as the REPowerEU plan, working in coordination with revised State Aid rules, the funding will be allocated to support reduced energy usage and the production of clean energy, to drive sustainability measures, to diversify energy supplies, and build out governance mechanisms.

At the country and local levels, numerous programs and policies have also been implemented, including a Belgian scheme to accelerate deployment of EV charging stations, a €5.8 billion French program for sustainable building renovations, and nearly €500 million for the installation of renewable energy technologies for businesses in Czechia, just to name a few.

Strategic Recommendation: ESG Checklist for Corporate Leaders

In conclusion, as businesses navigate the development and implementation of their tailored ESG missions, leveraging location strategy and economic incentives will be key to their success. As we work with our clients through these dynamic initiatives, we develop an ESG checklist that is created specifically to meet each company’s ESG vision. Through this checklist, CFOs and corporate leaders can evaluate the short- and long-term elements of their ESG commitments, with a critical focus on their geographic footprint and capital outlays. From there, we develop a customized strategy for the client to address the where and when to make investments, how to find talent, and what governance mechanisms need to be developed to ensure success.

-

David Hickey, Managing Director, Hickey & Associates

David P. Hickey is the managing director for Hickey and Associates, LLC, a global site selection, public incentive advisory, and workforce solutions company. David is a trusted advisor and partner for the company’s clients in providing strategy and advisory in site selection, economic incentives, and labor analytics.